This week was a good one. We received last dividends and interests for 2021 and we did made last adjustments in our portfolios.

We sold our position in Trainer's House @0,77020 and bought 1 share of Sampo @44,73 instead.

This week we received following income:

- 49,45 € from Blackrock

- 0,01 € interest from our bank accounts

- 0,56 € from Gladstone Investment corp BDC

- 0,28 € from Gladstone Commercial Reit

- 3,36 € from Main Street Capital

- 17,56 € from Gilead Sciences

- 20,00 € from Citycon

- 7,72 € from A&W Revenue Royalties

- 6,11 € from Methanex

- 8,27 € from Cohen & Steers Infrastructure Fund

- 13,80 € from Transalta Renewables

- 25,73 € from Brookfield Infrastructure

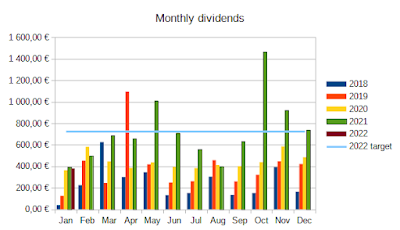

- 35,96 € from Simon Property group

So our income in the last week of the year was 188,81 € which is really good. Total amount of passive income in December was 738,95 €. December was extremely good month for us as was the whole year 2021. Our total passive income in 2021 was 8678,51 € so we almost reached the target which we have set for 2022! We are positively surprised.

In the last quarter our portfolio developed well. As we did not make many purchases in the last month, we have a bit more cash in our portfolio than usually. Our cash positions increased more than 100% in last quarter. As we do not really invest in funds, our mutual funds increased only a fraction, but still increased a bit. We have considered withdrawing money from the coops, but we have not done it yet. The reason why we consider withdrawing money from them is that coops have cut the yearly interest paid for the capital invested.

Our position in shares has increased very well on last quarter. There is substantial growth in both value of the stocks and new invested money for stocks. Our gross investment portfolio has grown 8,87% within last 3 months. Our investment loans have been decreasing a bit faster than the plan is and amount of loan has decreased by 8,1% in the last quarter. Our net investment portfolio has grown 10,39% in the last quarter. Our net investment portfolio grew total of 80 190,89 € in 2021. We are very happy with our portfolio increase in 2021.

Investment portfolio

| Asset class | 31st Dec 20 | 1st Apr 21 | 1st Jul 21 | 1st Oct 21 | 31st Dec 21

|

|---|

| Cash | 1 174,52 € | 494,25 € | 1 519,58 € | 3 079,84 € | 6 396,97 €

|

| Investment funds | 10 342,75 € | 10 331,28 € | 9 828,76 € | 9 829,82 € | 9 834,18 €

|

| Coop memberships | 1 500 € | 1 500 € | 1 500 € | 1 500 € | 1 500 € |

| Shares | 158 383,37 € | 186 531,00€ | 197 263,20 € | 211 134,20 € | 227 828,13 €

|

| Gross investment portfolio | 171 400,64 € | 198 856,53 € | 210 111,54 € | 225 543,86 € | 245 559,28 €

|

| Investment loan | 23 023,01 € | 21 015,97 € | 20 010,80 € | 18 489,23 € | 16 990,76 €

|

| Net investment portfolio | 148 377,63 € | 177 840,56 € | 190 100,74 € | 207 054,63 € | 228 568,52 €

|