This week was very boring. Brookfield Infrastructure and Inter Pipeline merge happened but something went wrong in our portfolio and we asked clarification from our broker. We are sure that this will be sorted out shortly. In short, we received too small amount of Brookfield Infrastructure shares, and we received more CAD than we expected. Also our portfolio now has unexpected USD debt which matches to purchasing the stocks we received and we are missing CAD matching the price of the received stocks.

We did not make any transactions this week and we received only following dividends:

- 6,26 € from British American Tobacco

- 27,84 € from Royal Bank of Canada

- 1 share from Main Street Capital DRIP worth of 36,70 €

- -3,74 € withheld taxes from Main Drip

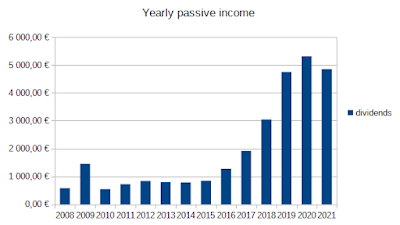

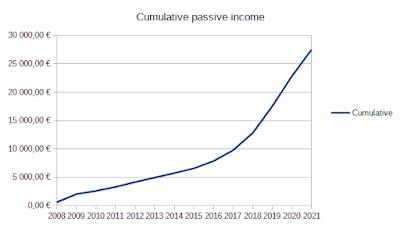

Total amount of dividends this week was 67,06 and so far this month 333,85€. We are still expecting to receive the usual dividends on last day of the month, but we will fall short of our monthly target as expected.