Happy Easter to everyone who celebrates.

As month changed we had our investment loan payment time. We paid back 501,84 € principal and 23,78 € fees and interests.

During the week we made three small purchases. We bought 3 shares of Sampo @39,34 € and 3 shares of Fortum @22,97666 €. Also we bought 14 shares of Prospect Capital @7,93860 USD. These purchases will increase our 2021 dividend income to 14,04 €.

We received following dividends:

- 1,77 € from Methanex

- 13,51 € from Transalta Renewables

- 14,03 € from Pepsico

- 13,72 € from LTC Properties

- 0,26 € from Gladstone Commercial REIT

- 0,30 € from Gladstone Investment Corporation BDC

- 7,48 € from Cibus Nordic

- 17,33 € from Telus Corp

- 4,71 € from Genuine Parts Company

- 19,74 € from Coca-Cola

- 0,25 € from Stellantis, as spin-off cash part.

In total dividend income was 93,1 €, but it is divided to two months.

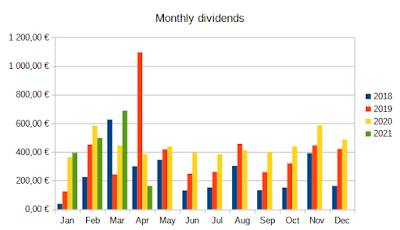

In March we received 688,25 in dividends and Q1/2021 total dividends amounted to 1579,05 €. As our target was 1575 €/Q, we caught up what we were behind. Now we are very slightly ahead of target pace. Dividends received in April are now 49,26 €.

As quarter changed it is time to make summary of our portfolio:

Investment portfolio

| Asset class | 1st Apr 20

| 1st Jul 20

| 1st Oct 20

| 31st dec 20

| 1st Apr 21

|

|---|

| Cash | 1 344,51 € | 700,81 € | 596,23 € | 1 174,52 € | 494,25 € |

| Investment funds | 10 478,22 € | 10 377,73 € | 10 383,21 € | 10 342,75 € | 10 331,28 € |

| Coop memberships | 1 500 € | 1 500 € | 1 500 € | 1 500 € | 1 500 € |

| Shares | 98 487,31 € | 132 343,57 € | 140 797,57 € | 158 383,37 € | 186 531,00€ |

| Gross investment portfolio | 111 810,04 € | 144 922,11 € | 151 777,01 € | 171 400,64 € | 198 856,53 € |

| Investment loan | 6 166 € | 25 740 € | 24 525,88 € | 23 023,01 € | 21 015,97 € |

| Net investment portfolio | 105 644,04 € | 119 182,11 € | 127 251,13 € | 148 377,63 € | 177 840,56 € |