Our week started with interests from co-ops. We received 30€ interests. We now have received all interests from Co-ops this year. The total yield was a quite lot less than earlier years.

On Friday we received the usual end-month dividends. From LTC Properties Inc. we received 6,96 € after taxes and fees deducted. The second company paying us dividends at the end of the every month is Gladstone Capital. From there we received 4,61 € after taxes and fees.

So our capital income on last week of June was 41,57 €.

On Friday we bought 12 shares of Duke Energy. Again a bit expensive, but we try to increase utilities on our portfolio. This is progressing slowly, since we are still restructuring our other liabilities.

And now the mid-year review:

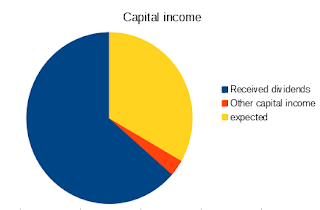

So far we have collected 2598,18 € capital income, which is 66,74% of our this year's target. There have been few dividend cuts and less interests from co-ops than expected. On other hand we have bought some new shares, which generate new cash flow. Also some of the companies have increased the dividends. So there is still a change to hit our target.

Our starting values were:

Investment funds: 11 241,88 €

Shares portfolio: 75 521,06 €

Coop memberships: 1 500 €

Total financial assets: 88 262,94 €

Loan for investment: 9361 €

Net financial assets 78 901,94 €

On a last business day of June values were:

Investment funds: 12 424,39 €, increase 10,52%

Shares portfolio: 80 078,12 €, increase 6,03%

Coop memberships: 1 500€, no change

Total financial assets: 94 002,51 €, increase 6,48%

Loan for investment: 8 296,00 €

Net financial assets 85 706,51 €, increase 8,62%

We are quite pleased with the progress.

a couple trying to increase passive income to secure income for retirement. Investing to dividend companies

Subscribe to:

Post Comments (Atom)

-

This was pretty good week, as usual in middle of the month. We finally received Pepsico dividends 13,97 € on Tuesday. On Wednesday we recei...

-

Only one working day left in July. We are going to receive some dividends next Monday so we cannot close the month yet in this blog. Last t...

-

First two weeks of August have passed and not so much has happened. During this period July ended and final amount of dividends in July was ...

No comments:

Post a Comment