Our week started with interests from co-ops. We received 30€ interests. We now have received all interests from Co-ops this year. The total yield was a quite lot less than earlier years.

On Friday we received the usual end-month dividends. From LTC Properties Inc. we received 6,96 € after taxes and fees deducted. The second company paying us dividends at the end of the every month is Gladstone Capital. From there we received 4,61 € after taxes and fees.

So our capital income on last week of June was 41,57 €.

On Friday we bought 12 shares of Duke Energy. Again a bit expensive, but we try to increase utilities on our portfolio. This is progressing slowly, since we are still restructuring our other liabilities.

And now the mid-year review:

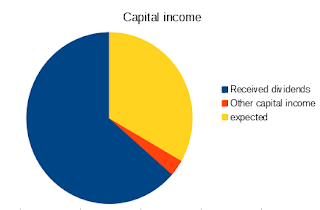

So far we have collected 2598,18 € capital income, which is 66,74% of our this year's target. There have been few dividend cuts and less interests from co-ops than expected. On other hand we have bought some new shares, which generate new cash flow. Also some of the companies have increased the dividends. So there is still a change to hit our target.

Our starting values were:

Investment funds: 11 241,88 €

Shares portfolio: 75 521,06 €

Coop memberships: 1 500 €

Total financial assets: 88 262,94 €

Loan for investment: 9361 €

Net financial assets 78 901,94 €

On a last business day of June values were:

Investment funds: 12 424,39 €, increase 10,52%

Shares portfolio: 80 078,12 €, increase 6,03%

Coop memberships: 1 500€, no change

Total financial assets: 94 002,51 €, increase 6,48%

Loan for investment: 8 296,00 €

Net financial assets 85 706,51 €, increase 8,62%

We are quite pleased with the progress.

a couple trying to increase passive income to secure income for retirement. Investing to dividend companies

Saturday, June 29, 2019

Saturday, June 22, 2019

3rd week of June

This week was very quiet. We received our first dividends from Dominion Energy. Net dividends received were 3,39 € after taxes and fees.

Saturday, June 15, 2019

2nd week of June

On the second week of the June we received our usual mid-month dividends. First, on Thursday we received dividends from Whitestone REIT. From Whitestone we received 49,03 € after taxes and fees deducted. On Friday we received 16,69 € dividends from Realty income. Realty Income also announced dividend increase earlier on this week. From Main Street Capital we received 19,49 € dividends.

On friday we also received our Canadian dividends. From Exchange Income Corp we received 15,51 CAD dividends. This is approximately 10,31 €. From Inter Pipeline we received 36,59 CAD dividends. This is approximately 24,40 €. Also Dream Global REIT paid us 10,05 CAD dividends. This is around 6,70€.

This week's dividend income was approximately 126,62 €. Pretty good week.Now we have accumulated 65,59% of our yearly target.

On friday we also received our Canadian dividends. From Exchange Income Corp we received 15,51 CAD dividends. This is approximately 10,31 €. From Inter Pipeline we received 36,59 CAD dividends. This is approximately 24,40 €. Also Dream Global REIT paid us 10,05 CAD dividends. This is around 6,70€.

This week's dividend income was approximately 126,62 €. Pretty good week.Now we have accumulated 65,59% of our yearly target.

Sunday, June 9, 2019

First week of June

Our week started with negative investment cashflow events. Repayment of the investment loan was on Monday. We paid 213,00 € capital, 6,10 € interests and 2,30 € fees.Total payment was 221,40. Now we have 8 296,00 € loan left.

On Monday we bought 5 shares of Dominion Energy. A bit expensive for our liking. By making this transaction we eliminated account management fees for Q3. We paid transaction fees 3.37 €, and now we have free account management for next quarter. Normal fee from bank is 1.95/month. This way we saved 2,48€ of fees and increased slightly our invested capital. We receiced 38,04 CAD dividends from Canadian Utilities after taxes deducted. This is approximately 25,26 €.

On 5th of June we received interests from May. Interests were 14,05 CAD, approximately 9,33 €.

On Thursday we received quarterly dividend from Nokia. Nokia changed its dividend policy from yearly dividend to quarterly dividend. Even though we get our money a bit later than in earlier years, we warmly welcome this change. We received 10€ from Nokia, no fees and no taxes deducted. On the same day we received dividends from Southern Company. We received 11,49 € after fees and taxes deducted.

Total capital gains from first week of June was 56,08 €.

On Monday we bought 5 shares of Dominion Energy. A bit expensive for our liking. By making this transaction we eliminated account management fees for Q3. We paid transaction fees 3.37 €, and now we have free account management for next quarter. Normal fee from bank is 1.95/month. This way we saved 2,48€ of fees and increased slightly our invested capital. We receiced 38,04 CAD dividends from Canadian Utilities after taxes deducted. This is approximately 25,26 €.

On 5th of June we received interests from May. Interests were 14,05 CAD, approximately 9,33 €.

On Thursday we received quarterly dividend from Nokia. Nokia changed its dividend policy from yearly dividend to quarterly dividend. Even though we get our money a bit later than in earlier years, we warmly welcome this change. We received 10€ from Nokia, no fees and no taxes deducted. On the same day we received dividends from Southern Company. We received 11,49 € after fees and taxes deducted.

Total capital gains from first week of June was 56,08 €.

Sunday, June 2, 2019

End of May

On 22nd of May Ocean Yield paid us 49,97 € dividends. The Ocean Yield is still on the "sell" list because norwegians take too much taxes. Now Norway owes us 12,66 €. Another solution would be to increase positions heavily on Norway to make the extra work meaningful. Claiming back the excess taxes will cost around 4-5 € and will take few hours of time. It is shame that Norway started this idiocy. It would be great if every small investor in the countries with tax treaty would claim back taxes transaction by transaction. We bet that they would change back to old way of doing this just because handling those applications would cause awful workload and cost more money than what they expected to get.

On 24th of May we received 24 € interests from coop memberships. So far we have received 44 € interests from our coop memberships. This is not awfully lot, but investment is almost as safe than keeping money on the bank account. At the moment our received interest rate is 2,93% p.a. We are expecting to get a bit more interests on June.

At the end of the month we received our usual end month dividends from LTC Properties and Gladstone Capital. From LTC Properties we received 7,11 € after taxes and fees deducted. From Gladstone Capital we received 4,71 €.

Now we have accumulated total of 2370,49€ of capital income. Our target for this year is 3892,78€. So we have collected 60,89% so far.

On 24th of May we received 24 € interests from coop memberships. So far we have received 44 € interests from our coop memberships. This is not awfully lot, but investment is almost as safe than keeping money on the bank account. At the moment our received interest rate is 2,93% p.a. We are expecting to get a bit more interests on June.

At the end of the month we received our usual end month dividends from LTC Properties and Gladstone Capital. From LTC Properties we received 7,11 € after taxes and fees deducted. From Gladstone Capital we received 4,71 €.

Now we have accumulated total of 2370,49€ of capital income. Our target for this year is 3892,78€. So we have collected 60,89% so far.

Subscribe to:

Comments (Atom)

-

This was pretty good week, as usual in middle of the month. We finally received Pepsico dividends 13,97 € on Tuesday. On Wednesday we recei...

-

Only one working day left in July. We are going to receive some dividends next Monday so we cannot close the month yet in this blog. Last t...

-

First two weeks of August have passed and not so much has happened. During this period July ended and final amount of dividends in July was ...