Third quarter is over. Although last month felt awful regarding the development of stock prices we managed to get positive progress in values of our portfolio. Of course a lot of this is explained by reinvestment of dividends and new money put on portfolio. Cash fell a little bit from last quarter. Investment funds decreased significantly since we moved some money to shares. Amount in shares grew a bit and investment loan decreased a bit faster than the plan is.

Investment portfolio

| Asset class | 1st Oct 21 | 31st Dec 21

| 31st Mar 22 | 30th Jun 22 | 30th Sep 22 |

|---|

| Cash | 3 079,84 € | 6 396,97 €

| 7 107,92 € | 6 761,52 € | 6 443,06 € |

| Investment funds | 9 829,82 € | 9 834,18 €

| 9 831,25 € | 11 267,08 € | 9 458,8 € |

| Coop memberships | 1 500 € | 1 500 € | 1 500 € | 1 500 € | 1 500 € |

| Shares | 211 134,20 € | 227 828,13 €

| 241 359,58 € | 233 072,96 € | 237 740,19 € |

| Gross investment portfolio | 225 543,86 € | 245 559,28 €

| 259 799,02 € | 252 610,56 € | 255 142,05 € |

| Investment loan | 18 489,23 € | 16 990,76 €

| 14 225,10 € | 13 365,98 € | 12 446,07 € |

| Net investment portfolio | 207 054,63 € | 228 568,52 €

| 245 573,92 € | 239 244,58 € | 242 695,98 € |

This week we purchased 1 share of Sampo @44,42 €. We estimate this to increase our 2023 dividends by 2,68 €. We also bought 30 shares of Kesko A @18,32833 € which should increase our 2023 income by 22,35 €. We have now bought 5% of our long term target of Kesko A. We will keep buying Kesko now and then for long time if price is right.

This week we received following dividends:

- 16,42 € from LTC Properties

- 0,65 € from Gladstone Investment Corporation BDC

- 18,20 € from Gladstone Commercial Reit

- 4,56 € from Main Street Capital

- 21,88 € from AGL Energy

- 24,16 € from Gilead Sciences

- 9,55 € from Cohen & Steers Infrastructure Fund

- 9,87 € from Methanex

- 11,12 € from A&W Revenue Royalties

- 14,85 € from Transalta Renewables

- 20,00 € from Citycon

- 20,18 € from HSBC Holdings

- 23,08 € from Brookfield Infrastructure

- 29,82 € from Alpine Income Property Trust

- 44,03 € from Simon Property Group

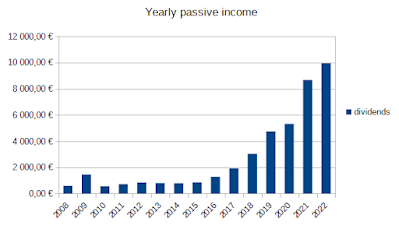

This week's dividend income was 268,37 which is really good. September was our 3rd best month dividendwise this year even though our bank failed to deliver some of the month end dividends on time. We ended up receiving 977,73 € in September and we would have reach the magical 1000 € in dividends if bank hadn't failed.