Yet another week passed by. The week was pretty ordinary. We received dividends and reinvested them. The value of portfolio has decreased quite lot this week, but we do not really follow it. We focus more on following development of cashflow. The value of the portfolio is secondary.

We bought following shares:

- 12 shares of Kesko A @19,66333 €

- 5 shares of Kemira @11,968 €

We estimate that these purchases will increase our 2023 income approximately by 15 €. It's not much but still it's progress. We now have 14 weeks' head start building 2023 portfolio.

This week we received following dividends:

- 11,27 € from Dominion Energy

- 74,52 € from Kesko A

- 67,43 € from Blackrock Inc

- 2,10 € from Capman

- 58,12 € from Manulife Financial

- 1 share of Main Street Capital DRIP worth 40,49 €

- 7,43 € as a remainder of Main DRIP

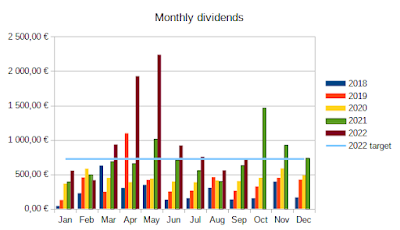

Total amount of dividends received this week was 261,36 € which is better than average. We have accumulated 709,36 € so far in September. This means that we will exceed our target of 725 €. So far we have had only 3 months below our target pace, January, February and August. Rest of the months we have reached the target. In 2022 we have only reached next year's monthly target of 1000 € in April and May so we really need to put our cash to work.