The last week of July was pretty good one. We made a few purchases and received month end dividends. Usually we do not follow our investment value during the quarter but for some reason we did so this week and hit new ATH with our portfolio.

This week's purchases:

- 18 shares of Kesko A @22,11888 €

- 22 shares of Bank of Montreal @127,85909 CAD

- 3 shares of Sampo @42,57 €

This week's purchases will increase our 2022 dividend income approximately by 40 €.

This week's dividends received:

- -4,86 € to Apollo Investment Taxes

- 28,98 € from Transcontinental Inc

- 5,56 € as a remainder of Apollo Investment DRIP

- 3,23 € from Canadian Imperial Bank of Commerce

- 19,29€ from Clime Capital

- 9,17 € from Cohen & Steers Infrastucture Fund

- 11,39 € from A&W Revenue Royalties

- 15,29 € from Transalta Renewables

- 11,19 € from MSC Industrial Direct

- 15,75 € from LTC Properties

- 17,46 € from Gladstone Commercial Reit

- 0,62 € from Gladstone Investment Corp BDC

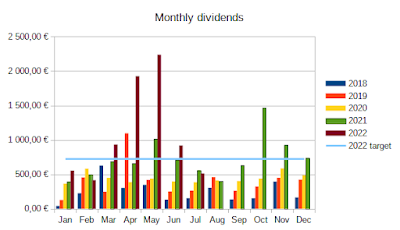

Total amount of dividends was 133,07 € on last week. That brings July dividends to 754,73 €, which is more than target amount. So far we haven't met target in two months, January and February. We expect August to be a weak month and we will not reach the target of 725 €, not even close. We definitely need to strenghten the middle months of quarters.