Month turned to June. It was again time to pay installment of our investment loan. We paid back 286,46 € principal and 13,54 € fees and interests. Next month our expenses of the loan are a bit higher than now because the yearly interest revision date is in this month. The interests are now somewhat higher than year ago. Even though the interest rises the loan is still cheap, so we will not accelerate payments, yet. We will think about it again next spring.

We made some purchases because we received substantial amount of dividends.

We bought 82 shares of Kesko A @21,80268 €. This purchase will increase our dividends in 2022 by 64,78 €. We also bought 6 shares Canadian Imperial Bank of Commerce @70,11333 CAD.

We received following dividends:

In May:

- 14,98 € from LTC Properties

- 1668,74 € from Sampo

- 8,70 € from Cohen & Steers Infrastructure

- 10,93 € from A&W Revenue Royalties

- 14,65 € from Transalta Renewables

- 16,59 € from Gladstone Commercial REIT

- 0,59 € from Gladstone Investment Corp BDC

- 1,41 € from Sabra Health Care Reit

In June:

- 55,70 € from Canadian Utilities

- 71,72 € from Enbridge Inc

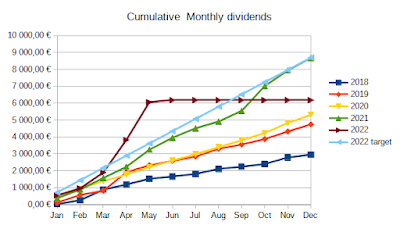

Total amount of passive income in May was 2236,38 € which is ATH dividend income in a month. In June we have already accumulated 124,47 € in dividends. The dividends from Sampo raised our yearly total dividend to the levels where we should be at August in order to meet our target. So we are now well ahead of our target pace, which is good. Our dividend income will be significantly lower on rest of the months.