Month changed to November. It was again time to make our monthly investment loan payment so we paid back 322,19 € principal and 27,81 € fees and interests. We are little bit ahead of our payback schedule because we round up the payment to some nice even number.

We are almost done with changing the broker. We are just waiting last dividends to arrive to old broker's account so that we can transfer rest of the money to our new broker. Then we can close the old account and we are done. Last dividends arrive on 15th of November so we can transfer money on 16th.

Dividend increases

Simon Property Group annouced a dividend increase. New quarterly dividend is 1.80 USD so increase is 0,05 USD/share. This will mean around 4,90 € increase in dividends in 2023.

CSR increased interim dividend by 0,03 AUD so we will receive approximately 9,17 € more dividends in 2022 than anticipated.

Third dividend increase this week was from Regency Centers. This is quite recently acquired holding in our portfolio. Regency Centers increased quarterly dividend by 4% increasing our 2023 dividends by 3,80 €.

Purchases

We bought 1 share of Capman @2,50 € with dividends received. That is the only transaction we made this week.

Dividends

We received following dividends and interests:

- 16,19 € from LTC Properties (September)

- 17,95 € from Gladstone Commercial Reit (September)

- 0,68 € from Gladstone Commercial Reit (September)

- 9,41 € from Cohen & Steers Infrastructure Fund (September)

- 14,74 € from Transalta Renewables (September)

- 10,99 € from A&W Revenue Royalties (September)

- 23,78 € from Kemira (November)

- 6,53 € from Cibus Nordic (November)

- 55,74 € from Verizon Communication Inc (November)

- 40,88 € from Telia Company (November).

- 0,23 € September interest income (November)

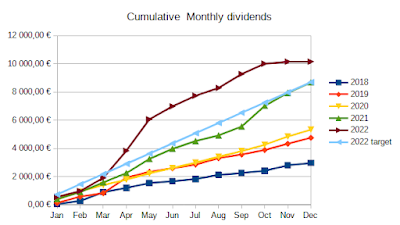

Total amount of capital income was 197,12 € which is fairly good for a week. Our September dividends were 736,79 € so we reached our monthly target also in September. Out of 10 months there are 3 months where we have not met the target.

Capital income in November is now at 127,16 €.