It is Midsummer fest. So nothing happens today and that's why update comes a day earlier than usual. Again it was a very satisfying week with activity almost every day. We had maintenance time for our cars, so we spent some of the cash we received from selling AT&T and reinvested rest of the cash.

We bought 33 shares of Gilead Sciences @67,15152 USD. This will increase our 2021 dividend income by 31,60 €. Also Simon Property Group annouced dividend increase. This increase means approximately 4 € increase to 2021 dividends.

We received following dividends:

- 5,39 € from Dominion Energy

- 46,94 € from Blackrock

- 44,26 € from Manulife Financial Group

- 1 share of Main Street Capital worth of 34,45€

- -3,17 as withholding tax from Main Street Capital DRIP

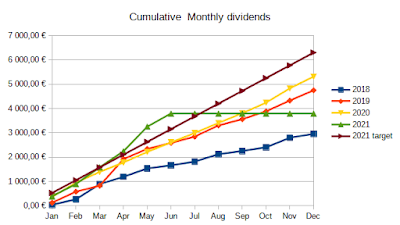

Dividend amount this week's was 127,87 €. It seems that June will be this year's second best month so far, which is pretty good since summer months have been bad months earlier in dividendwise.