One day left in August and last full week is over. For a long time this was a dividend free week until we bought a small position of Royal Bank of Canada. On Monday we received first dividends from that company. We received 8,26 CAD which is approximately 5,30 €. This would had been our only dividend for this week but we also received late dividends from Saratoga Investment. From Saratoga Investement we received 2 shares as a DRIP and remainder 2,12 € as a cash. Total dividend from the Saratoga was 29,82 €.

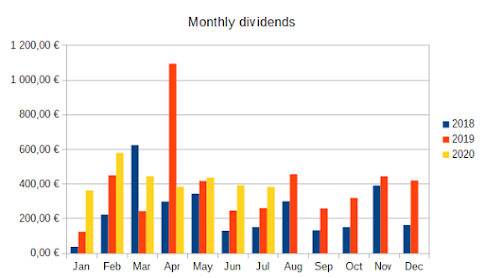

August will be second month in 2020 when we do not exceed the 2019 dividends. Last year August we received 456,89 € and this year we will end up to around 410 €.