A lot happened as the quarter ended.

We were able to increase our net investment portfolio by 6,77% during the third quarter. The cash in the investment accounts went down a bit. Our stock portfolio rose 6,39% and loans went down by 4,72%. We are going to right direction. Below is the updated investment portfolio.

Investment portfolio

| Asset class | 1st Oct 19

| 31st Dec 19

| 1st Apr 20

| 1st Jul 20

| 1st Oct 20

|

|---|

| Cash | N/A | 1 799,70 € | 1 344,51 € | 781 € | 596,23 € |

| Investment funds | 10 725,61 € | 10 478,22 € | 10 478,22 € | 10 377,73 € | 10 383,21 € |

| Coop memberships | 1 500 € | 1 500 € | 1 500 € | 1 500 € | 1 500 € |

| Shares | 119 731,61 € | 124 914,13 € | 98 487,31 € | 132 343,57 € | 140 797,57 € |

| Gross investment portfolio | 131 957,22 € | 138 692,05 € | 111 810,04 € | 144 922,11 € | 151 777,01 € |

| Investment loan | 7 657 € | 7 018 € | 6 166 € | 25 740 € | 24 525,88 € |

| Net investment portfolio | 124 300,22 € | 131 674,05 € | 105 644,04 € | 119 182,11 € | 127 251,13 € |

At the beginning of October it was time to make our monthly investment loan payment. We paid back 500,89 € of principal and 24,89 € interests and fees.

This week we bought 17 shares of AT&T @28,785 USD and 6 shares of LTC Properties @36,6832 USD. These will increase our 2020 dividend income approximately by 10 €.

This week we received dividends from following companies:

Last day of September:

We did not receive Pepsi Co dividend on 30th September since our bank failed again to deliver it to us. It also failed to deliver the dividends that should have been paid on the first day of October.

On the second day of October we received:

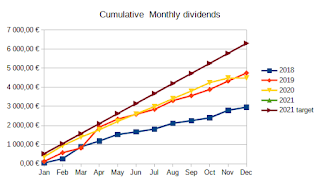

So we are still missing our Pepsi Co dividends. We received total of 401,33 € in September. Not too bad but still missed the target. Currently we are 174,33 € behind the target pace, but considering the situation we are pleased. We will not reach the target but we get pretty close. In October we have now collected 52,16 € dividends.