Again a quiet week. There were some bad news of our holdings.Nokia announced its q3 results and it was a major disappointment. They also cut off dividends. We are considering selling this constant underperformer if something significant does not show up. This would realise some losses, but we had already given Nokia this year to show us that it can change. Does not seem so. Also Nordea cut its dividend by 42%, but this was expected. We are confident with Nordea. Third annoucement was that Sampo most likely will cut its dividend down to 2.10-2.30 € per share. We do not plan to sell Sampo. These news give us some troubles to keep up increasing our dividend stream.

Now we decided our next year target for passive income. It is 5300 € investment income received to our accounts. This mean that we will increase our goal by 36%, which is quite big increase but we think we can do it.

Now to this week's income. Only Clime Capital paid us dividends. We received 23,38 AUD dividends after taxes, which is approximately 14,34 €. We still need 88,94 € to meet our target for this year. This will happen next week.

a couple trying to increase passive income to secure income for retirement. Investing to dividend companies

Saturday, October 26, 2019

Friday, October 18, 2019

Mid month update

Last week absolutely nothing happened. That's why we did not update the blog. No trades, no dividends. Actually Whitestone REIT paid dividends on 10th of October, but for some reason we did not receive dividends to our account until this week.

We started our week by making a technical buy. As told earlier we have several portfolios and our bank charges fees from inactive portfolios. We bought 1 share of Johnson & Johnson @131 USD. Now our total position at JNJ is 14 shares. We do not need to buy any more shares to this account this year to keep it free for end of first quarter of 2020. Transaction fee is less than one month's charge for passive portfolios.

On Tuesday 15th, we received Whitestone REIT dividends and our normal mid-month dividends, except from Dream Global REIT, which suspended dividend payments after Blackstone wanted to buy Dream Global REIT. From Whitestone REIT we received 50,26 € after taxes and fees deducted. From Realty Income we received 17,15 € after taxes and fees. Last US company who paid dividends on 15th of October was Cardinal Health Inc. We received 36,35 € after taxes and fees. From Inter Pipeline we received 36,46 CAD dividends after taxes deducted. This is approximately 25,02 €. And from Exchange Income we received 16,15 CAD dividends after taxes which is about 11,08 €. We also sold our position at Dream Global REIT @16,64 CAD, which is a little less than what Blackstone offers, but we do not need to wait until end of the year to receive money. This sell brought us 467,00 CAD profit. We reinvested cash and some received dividends to Transcontinental Inc. We bought 200 shares @15,13 CAD.

On Wednesday we received our last dividends for the week. From Main Street Capital we received 20,43 € after taxes and fees. Also we noticed that Main Steet Capital annouced supplemental dividend payable at december. This will increase our dividend income approximately by 24 €.

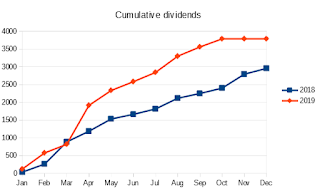

Our October dividends have now exceeded the last year's October dividends. Now we have accumulated 3789,50 € passive income this year which is 97,35% of our this year's target. We are 103,28 € short from our target. We will exceed our target latest 1st of November.

We started our week by making a technical buy. As told earlier we have several portfolios and our bank charges fees from inactive portfolios. We bought 1 share of Johnson & Johnson @131 USD. Now our total position at JNJ is 14 shares. We do not need to buy any more shares to this account this year to keep it free for end of first quarter of 2020. Transaction fee is less than one month's charge for passive portfolios.

On Tuesday 15th, we received Whitestone REIT dividends and our normal mid-month dividends, except from Dream Global REIT, which suspended dividend payments after Blackstone wanted to buy Dream Global REIT. From Whitestone REIT we received 50,26 € after taxes and fees deducted. From Realty Income we received 17,15 € after taxes and fees. Last US company who paid dividends on 15th of October was Cardinal Health Inc. We received 36,35 € after taxes and fees. From Inter Pipeline we received 36,46 CAD dividends after taxes deducted. This is approximately 25,02 €. And from Exchange Income we received 16,15 CAD dividends after taxes which is about 11,08 €. We also sold our position at Dream Global REIT @16,64 CAD, which is a little less than what Blackstone offers, but we do not need to wait until end of the year to receive money. This sell brought us 467,00 CAD profit. We reinvested cash and some received dividends to Transcontinental Inc. We bought 200 shares @15,13 CAD.

On Wednesday we received our last dividends for the week. From Main Street Capital we received 20,43 € after taxes and fees. Also we noticed that Main Steet Capital annouced supplemental dividend payable at december. This will increase our dividend income approximately by 24 €.

Our October dividends have now exceeded the last year's October dividends. Now we have accumulated 3789,50 € passive income this year which is 97,35% of our this year's target. We are 103,28 € short from our target. We will exceed our target latest 1st of November.

Sunday, October 6, 2019

Q3 summary and first week of October

Third quarter ended on Monday. It is time to make summary of our investments again but first we sum up this week's activities.

On the last day of September we received first time dividends from Transalta Renewables. We received 19,97 CAD after taxes deducted, which is approximately 13,82 €. On the same day we also received 7,23 € dividends from LTC Properties. Also the DRIP and remainder from HSBC arrived on the last day of September. We received 3 shares and 0,53€ cash dividends which adds up to 19,76 € dividends. These raised our September dividend income to 259,32 €, which is 94,6% higher than last year's September dividends.

On the first day of October we received 20,23€ dividends after taxes and fees deducted from Coca Cola. As usual, we made our investment loan payment on the first day of the month. We paid back 213 € principal and 6,76 € interests and fees. We increased our position at Johnson & Johnson by 8 shares @130,30 USD. We also received 2 shares of Saratoga Investment Corp. This increases our dividend income by 42,70 €.

On Wednesday remainder of Saratoga Investment Corp dividends arrived on our account. We received 1,01 € after taxes and fees deducted. Also we received 4,65 € dividends after taxes and fees deducted from Iron Mountain Inc.

Now the quarterly check for our portfolio.

On 30th of September.

Investment funds 10 725,61 €

Shares portfolio 119 731,61 €

Co-op memberships 1 500 €

Gross investments 131 957,22 €

Investment loan 7 657 €

Net investments 124 300,22 €.

Our net investment value has increased 57,54% this year.

Currently we have accumulated 3629,30 € capital income, which is 93,23% of our this year's target. We still need to accumulate 263,48 € to reach the target. We have calculated that most likely we will hit the target first week of November.

On the last day of September we received first time dividends from Transalta Renewables. We received 19,97 CAD after taxes deducted, which is approximately 13,82 €. On the same day we also received 7,23 € dividends from LTC Properties. Also the DRIP and remainder from HSBC arrived on the last day of September. We received 3 shares and 0,53€ cash dividends which adds up to 19,76 € dividends. These raised our September dividend income to 259,32 €, which is 94,6% higher than last year's September dividends.

On the first day of October we received 20,23€ dividends after taxes and fees deducted from Coca Cola. As usual, we made our investment loan payment on the first day of the month. We paid back 213 € principal and 6,76 € interests and fees. We increased our position at Johnson & Johnson by 8 shares @130,30 USD. We also received 2 shares of Saratoga Investment Corp. This increases our dividend income by 42,70 €.

On Wednesday remainder of Saratoga Investment Corp dividends arrived on our account. We received 1,01 € after taxes and fees deducted. Also we received 4,65 € dividends after taxes and fees deducted from Iron Mountain Inc.

Now the quarterly check for our portfolio.

On 30th of September.

Investment funds 10 725,61 €

Shares portfolio 119 731,61 €

Co-op memberships 1 500 €

Gross investments 131 957,22 €

Investment loan 7 657 €

Net investments 124 300,22 €.

Our net investment value has increased 57,54% this year.

Currently we have accumulated 3629,30 € capital income, which is 93,23% of our this year's target. We still need to accumulate 263,48 € to reach the target. We have calculated that most likely we will hit the target first week of November.

Subscribe to:

Comments (Atom)

-

This was pretty good week, as usual in middle of the month. We finally received Pepsico dividends 13,97 € on Tuesday. On Wednesday we recei...

-

Only one working day left in July. We are going to receive some dividends next Monday so we cannot close the month yet in this blog. Last t...

-

First two weeks of August have passed and not so much has happened. During this period July ended and final amount of dividends in July was ...