Again a quite quiet week in investment sector.

This week we made a bit unusual investment to a fund. We do not usually invest in funds, but this time we did so because the insurance company has changed their loyalty program, which we hadn't noticed earlier. Investing in one or more funds managed by our insurance company raises the loyalty discounts by one tier. The company has 4 tiers, and we have been on 3rd tier earlier. By investing into the fund we raised us to the 4th tier, which means additional 4% discount to the insurance fees. We invested 100 €. This way we lowered our total insurance bill approximately 40 € annually. We are not expecting a lot of profits from this investment, but we hope that it will keep its value and beat the inflation. That is enough for us.

And now to the investment income for the week. On the 9th of June we received 24,52 € dividends from

Main Street Capital after taxes and fees deducted.

The

HSBC paid its dividends on the 11th of June. As we are participating the DRIP, we received 2 shares. The exact value is still a bit unclear, since we receive the report later on paper. The value is approximately 14,79 €. We will get cash dividend from fractional parts later, most likely next week.

Whitestone REIT dividends should arrive to our account later on today. We are expecting to get around 49 € net dividends. We will update the exact amount when the dividends arrive.

Edit: Dividends from Whitestone arrived and exact amount was 49,13 € after taxes and fees.

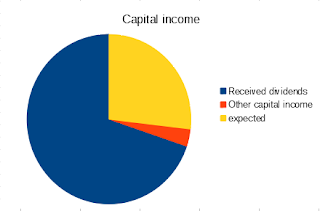

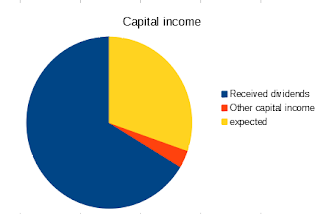

After this week we have received approximately 2714 € capital income. This is 69,70% of our yearly target. At this speed we will most likely exceed our target income for the year.