Nothing really happened.

We received 20 € interests from Coop memberships and 10 euros was automatically transferred to funds.

Excess dividends after DRIP from HSBC received. On Friday we received 3,68€ after fees deducted.

This year so far we have had 3 weeks without passive income and 1 weeks with less than 10 euros passive income.

a couple trying to increase passive income to secure income for retirement. Investing to dividend companies

Saturday, April 27, 2019

Monday, April 22, 2019

Mid-April dividends

The week started with dividends from Canadian and US companies. From Inter pipeline Ltd we received monthly dividend 36,46 CAD after taxes witheld, which is approximately 24,20 €. Another Canadian company, which pays us monthly dividend is Exchange Income Corp. From Exchange Income we received 15,51 CAD, which is 10,30 €.US companies who paid us on Monday were Main Street Capital, Realty Income Corp and Whitestone Reit. From Main Street Capital we received 12,56 € after taxes and fees, from Realty Income Corp 16,70 € and from Whitestone Reit 49,15. We just realized that our monthly dividends at middle of the month are over 100 euros.

On 18th of April we received DRIP shares from HSBC Holdings. We received 5 shares. Our position at HSBC is now 221 shares. the value of the shares was approximately total of 38,58 €. We also received dividends from Sampo 169,86 € after taxes witheld. From Telia Company we received 57,34 € after taxes and fees deducted.

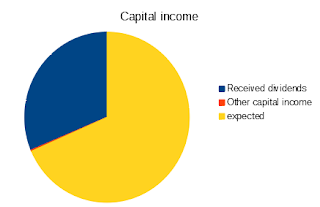

Total amount of net dividends received in week 16 was 378,69 €. Pretty good week. Now our total net divideds for the year is 1875,78€ and other capital income 11,99€.

On 18th of April we received DRIP shares from HSBC Holdings. We received 5 shares. Our position at HSBC is now 221 shares. the value of the shares was approximately total of 38,58 €. We also received dividends from Sampo 169,86 € after taxes witheld. From Telia Company we received 57,34 € after taxes and fees deducted.

Total amount of net dividends received in week 16 was 378,69 €. Pretty good week. Now our total net divideds for the year is 1875,78€ and other capital income 11,99€.

Saturday, April 13, 2019

14th week of blogging

On Monday we received dividends from Nordea. We received 591,15 € after taxes deducted.

Now our total net dividend income year to date is near 1500 €, 1497,02 to be exact. We calculated that our estimated yearly passive income will cover 10% of our yearly expences. So one milestone reached.

Now our total net dividend income year to date is near 1500 €, 1497,02 to be exact. We calculated that our estimated yearly passive income will cover 10% of our yearly expences. So one milestone reached.

Saturday, April 6, 2019

summary of first quarter and start of the 2nd.

Our investment activity is still on low since we are focusing to reducing risks by paying some of the non-investment related loans. We are going to do so for the next 6 months.

Week 11

The week was very quiet. The only company that paid dividends to us was Main Street Capital. We received 8,58 € after taxes and fees deducted. Nothing else happened.

Week 12

The last week of the March. We received dividends from LTC Properties. The net dividend was 7,06 €. We also received 4,98 € net dividends from Gladstone Capital. Also Corus Entertainment paid us 5,10 CAD dividends, taxes deducted. This was approximately 3,41 €.

Summary of the first quarter.

Our passive income in Q1 was lower than last year. The reason for this was that one company will pay dividends in April instead of March. We received total of 820,38 € passive income in first quarter. We bought few shares of AT&T, Nordea, Canadian Utilities, Main Street Capital, Inter Pipeline and Gladstone Capital. Also reinvested Verizon Communication dividends.

Week 13

We paid back 213 € of our investment loan and paid interests 8,71 €. Total payment was 221,71 €. 2nd April we received dividends from Kojamo 21,60 € after taxes deducted. 4th April Coca-Cola paid dividends. We received 19,67 € after taxes and fees deducted. Outokumpu paid its dividends on 5th April. After taxes we received 55,87 €. We bought 22 shares of Main Street Capital with total of 749,36 €.

Week 11

The week was very quiet. The only company that paid dividends to us was Main Street Capital. We received 8,58 € after taxes and fees deducted. Nothing else happened.

Week 12

The last week of the March. We received dividends from LTC Properties. The net dividend was 7,06 €. We also received 4,98 € net dividends from Gladstone Capital. Also Corus Entertainment paid us 5,10 CAD dividends, taxes deducted. This was approximately 3,41 €.

Summary of the first quarter.

Our passive income in Q1 was lower than last year. The reason for this was that one company will pay dividends in April instead of March. We received total of 820,38 € passive income in first quarter. We bought few shares of AT&T, Nordea, Canadian Utilities, Main Street Capital, Inter Pipeline and Gladstone Capital. Also reinvested Verizon Communication dividends.

Week 13

We paid back 213 € of our investment loan and paid interests 8,71 €. Total payment was 221,71 €. 2nd April we received dividends from Kojamo 21,60 € after taxes deducted. 4th April Coca-Cola paid dividends. We received 19,67 € after taxes and fees deducted. Outokumpu paid its dividends on 5th April. After taxes we received 55,87 €. We bought 22 shares of Main Street Capital with total of 749,36 €.

Subscribe to:

Comments (Atom)

-

This was pretty good week, as usual in middle of the month. We finally received Pepsico dividends 13,97 € on Tuesday. On Wednesday we recei...

-

Only one working day left in July. We are going to receive some dividends next Monday so we cannot close the month yet in this blog. Last t...

-

First two weeks of August have passed and not so much has happened. During this period July ended and final amount of dividends in July was ...