In 4th week of December we received dividends only from Blackrock. We received 40,36 € taxes and fees deducted.

Now our accumulated passive income in December is 359,01 €. We still have some dividends to come for this year so we will make summary of the year after that.

a couple trying to increase passive income to secure income for retirement. Investing to dividend companies

Sunday, December 29, 2019

Saturday, December 21, 2019

3rd week of December

Our week was pretty active. Not as active as last week but still.

On Monday 16th we received 36,46 CAD dividends from Inter Pipeline Ltd after taxes which is approximately 24,88 €, 8,62 € dividends from Duke Energy after taxes and fees deducted and 29,72 € dividends from Monmouth Real Estate Investment Corp.

On Tuesday we sold some of our funds and realised 24,97 € profit. We freed 255,51 € capital from funds to be invested somewhere else later.

On Friday we received 3,49 € dividends from Dominion Energy after taxes and fees deducted.

Today our December passive income is 318,65 €. We still have some dividends to come this year.

We still have to do some work to reach next year target. Now we predict that in January we do not reach the target of 442€ monthly passive income, but April will cover that. With current portfolio we have only four months when we reach our target of 442 € passive income.

On Monday 16th we received 36,46 CAD dividends from Inter Pipeline Ltd after taxes which is approximately 24,88 €, 8,62 € dividends from Duke Energy after taxes and fees deducted and 29,72 € dividends from Monmouth Real Estate Investment Corp.

On Tuesday we sold some of our funds and realised 24,97 € profit. We freed 255,51 € capital from funds to be invested somewhere else later.

On Friday we received 3,49 € dividends from Dominion Energy after taxes and fees deducted.

Today our December passive income is 318,65 €. We still have some dividends to come this year.

We still have to do some work to reach next year target. Now we predict that in January we do not reach the target of 442€ monthly passive income, but April will cover that. With current portfolio we have only four months when we reach our target of 442 € passive income.

Sunday, December 15, 2019

Second week of December

First update to first week's events. On 2nd of December we paid back some of our investment loan. 213 € principal and 6,16 € interests and fees.

And now to second week. On 9th of December we received 11,87 € dividends from Southern Co after taxes and fees deducted. Next day we received 10,17 € dividends from Johnson & Johnson and 27,20 AUD dividends from Washington H. Soul Pattinson which is approximately 16,76 €. On 12th of December we received 50,61 € dividends from Whitestone REIT after taxes and fees deducted, 20,25 € dividends from Main Street Capital and 83 AUD dividends from National Australia Bank which is approximately 51,31 €. On Friday 13th we received 16,15 CAD dividends from Exchange Income which is approximately 10,98 € and 17,23 € dividends from Realty Income after taxes and fees deducted.

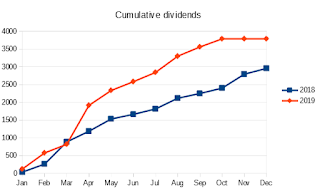

Our total passive income in December has already passed our last year's December income. Now we have accumulated 211,55 € passive income in December.

We noticed that some of our holdings have annouced dividend increase. First Realty Income increased its monthly dividend by 0,05 cnt/ share. This will increase our monthly gross income by 5 cnt/ month. AT&T annouced 1 cnt/share increase on quarterly dividend. This will increase our quarterly gross income by 2,5 USD.

And now to second week. On 9th of December we received 11,87 € dividends from Southern Co after taxes and fees deducted. Next day we received 10,17 € dividends from Johnson & Johnson and 27,20 AUD dividends from Washington H. Soul Pattinson which is approximately 16,76 €. On 12th of December we received 50,61 € dividends from Whitestone REIT after taxes and fees deducted, 20,25 € dividends from Main Street Capital and 83 AUD dividends from National Australia Bank which is approximately 51,31 €. On Friday 13th we received 16,15 CAD dividends from Exchange Income which is approximately 10,98 € and 17,23 € dividends from Realty Income after taxes and fees deducted.

Our total passive income in December has already passed our last year's December income. Now we have accumulated 211,55 € passive income in December.

We noticed that some of our holdings have annouced dividend increase. First Realty Income increased its monthly dividend by 0,05 cnt/ share. This will increase our monthly gross income by 5 cnt/ month. AT&T annouced 1 cnt/share increase on quarterly dividend. This will increase our quarterly gross income by 2,5 USD.

Monday, December 9, 2019

First week of December

December started slowly. On 2nd of December we received 32,33 CAD dividends after taxes from Canadian Utilities which is approximately 21,94 €. We also received 0,63 CAD interests which is approximately 0,43 € on 5th of December. These were our only passive income on first week.

We probably made our this year's last purchases on the first week. On 2nd of December we bought 100 shares of Apollo Investment Corporation @ 16,98 USD and 13 shares of MSC Industrial direct Co @ 72,89 USD. On 3rd of December we bought 15 shares of Iron Mountain @ 32,10 USD.We increased our position to 25 shares in Iron Mountain.

We probably made our this year's last purchases on the first week. On 2nd of December we bought 100 shares of Apollo Investment Corporation @ 16,98 USD and 13 shares of MSC Industrial direct Co @ 72,89 USD. On 3rd of December we bought 15 shares of Iron Mountain @ 32,10 USD.We increased our position to 25 shares in Iron Mountain.

Saturday, November 30, 2019

End of November

Another slow week. On last business day of November we received 7,31 € dividends from LTC Properties after taxes and fees deducted and 19,97 CAD dividends from Transalta Renewables after taxes which is approximately 13,64 €.

Our passive income in November was 445,88 € which is 14% higher than last year's November.

We are planning to make few small purchases in December to save on first quarter fees.Our forecast for December predicts significant raise for dividends compared to last year's December. We are considering to strenghten our January dividend income with these buys.

Our passive income in November was 445,88 € which is 14% higher than last year's November.

We are planning to make few small purchases in December to save on first quarter fees.Our forecast for December predicts significant raise for dividends compared to last year's December. We are considering to strenghten our January dividend income with these buys.

Saturday, November 23, 2019

3rd week of November

First, we had small error on numbers last week. We entered one dividend twice to our bookkeeping program, and we did not notice it until Wednesday this week. So actually last weeks numbers were 11 euros too big. Now figures are corrected.

This week we received dividends from two companies. On Monday we received 20,39 € dividends from Main Street Capital after taxes and fees deducted. On Wednesday we received 20,17 € dividends from HSBC. We normally participate HSBC DRIP, but for some reason this time the information did not reach our broker. We blame very unreliable Posti. It is not so uncommon that letters go missing. The reliability of the service has dropped drastically in few years.

And now corrected figures:

We have now accumulated 4306,49 € passive income this year and 17 125,66 € from 2008. This month we have accumulated 424,93 and actually we reached last years' November figures on Monday, not last week as we thought earlier.

This week we received dividends from two companies. On Monday we received 20,39 € dividends from Main Street Capital after taxes and fees deducted. On Wednesday we received 20,17 € dividends from HSBC. We normally participate HSBC DRIP, but for some reason this time the information did not reach our broker. We blame very unreliable Posti. It is not so uncommon that letters go missing. The reliability of the service has dropped drastically in few years.

And now corrected figures:

We have now accumulated 4306,49 € passive income this year and 17 125,66 € from 2008. This month we have accumulated 424,93 and actually we reached last years' November figures on Monday, not last week as we thought earlier.

Saturday, November 16, 2019

November, half way through

As usual our mid-month is pretty good. Week's first dividends came from Ocean Yield. We received 51,39 € after taxes and fees deducted on Wednesday. And because Norway has changed how they withold taxes, Norway now owes us approximately 20 euros. We are still planning to sell Ocean Yield, since it is our only Norwegian stock. We changed our plans to have more stocks from Norway since they changed their taxation to add extra bureucracy. It is shame, yet another European country, which tries to evade rules of avoiding double-taxation by adding red tape. So basically they follow treatys only if people demands correction later.

On Thursday we received dividends from two companies. From Whitestone REIT we received 51,25 € after taxes and fees deducted and from Senior Housing Properties Trust we received 23,12 € after taxes and fees deducted.

On Friday we received dividends from 5 companies. From Exchange Income we received 16,15 CAD dividends after taxes. This is approximately 11,05 €. From Inter Pipeline we received 36,46 CAD dividends after taxes, which is approximately 24,96 €. From Realty Income Corp we received 17,46 € after taxes and fees deducted. From Omega Healthcare Investors we received 51,54 € after taxes and fees deducted. From Abbvie we received 8,23 € after taxes and fees deducted.

On Friday we reached last year November dividends. Last year we we received 392,08 € dividends in November and this November we have already received 395,44 € dividends. December will be much better than last year's December, so March is only month this year when our passive income was less than last year.

On Thursday we received dividends from two companies. From Whitestone REIT we received 51,25 € after taxes and fees deducted and from Senior Housing Properties Trust we received 23,12 € after taxes and fees deducted.

On Friday we received dividends from 5 companies. From Exchange Income we received 16,15 CAD dividends after taxes. This is approximately 11,05 €. From Inter Pipeline we received 36,46 CAD dividends after taxes, which is approximately 24,96 €. From Realty Income Corp we received 17,46 € after taxes and fees deducted. From Omega Healthcare Investors we received 51,54 € after taxes and fees deducted. From Abbvie we received 8,23 € after taxes and fees deducted.

On Friday we reached last year November dividends. Last year we we received 392,08 € dividends in November and this November we have already received 395,44 € dividends. December will be much better than last year's December, so March is only month this year when our passive income was less than last year.

Saturday, November 9, 2019

quiet week

This week was very quiet. No dividends but at least we received some interests. We received 3,86 CAD interests, which is approximately 2,65 €. Luckily not another 0 income week. We have had total of 4 weeks in this year when we have not received any passive income. Two of them in January and one in February.

Saturday, November 2, 2019

Year 2019 goal reached!

We reached this year's target on last week of October. To be exact target was 11,22 € short at the end of October and dividends received on 1st of November broke the target.

We did not make any investments, because the traditional money pit, car, was on yearly maintenace and on maintenance some issues were found. Good bye free cash.

Our this week's financial activity started on 28th of October. We sold our position at Nokia. We realised 444,77 € loss on this position. The reason was total loss of trust to management and cutting the dividends. We were considering increase our position after the q3 results are public. Now we are very happy that we decided to wait results, even we made some losses. This capital went straight to the next money pit, repairing the car. Actually this transaction is our first loss with Nokia. We have owned Nokia shares several times and so far we have realised profits with this share. In total now we are even with Nokia.

First income we received this week was from Telia. On Wednesday we received 57,01 € after taxes and fees deducted. On last day of October we received 19,97 CAD dividends after taxes from Transalta Renewables which is 13,62 €. From LTC Properties we received 7,09 € after taxes and fees deducted.

On the first day of November we had our investment loan payment. We paid back 213 € capital and 6,42 € interests and fees. We also received some dividends. From AT&T we received 96,81 € after taxes and fees deducted. From Verizon communications we received 45,91 € after taxes and fees deducted.

Our investment income in October was 320,94 €. Last year our income was 151,51 in October. We predict that in November we do not get more dividends than last year. Our this year target was 3892,78 €, now we have accumulated 4024,28 € so we have accumulated 103,38%.

After reaching this year target, and setting the next year target to 5300 € we did some archeology work. We dug our archives and tracked down as much information as we could. We were able to dig up most of our passive income back to 2008. There are some inaccuracies in the data, but still most of the income is there.

From year 2008 onwards we have accumulated at least 16 843,45 € passive income, which is suprisingly lot. Income started to grow after 2015, being quite stable from 2008 to 2015.

We did not make any investments, because the traditional money pit, car, was on yearly maintenace and on maintenance some issues were found. Good bye free cash.

Our this week's financial activity started on 28th of October. We sold our position at Nokia. We realised 444,77 € loss on this position. The reason was total loss of trust to management and cutting the dividends. We were considering increase our position after the q3 results are public. Now we are very happy that we decided to wait results, even we made some losses. This capital went straight to the next money pit, repairing the car. Actually this transaction is our first loss with Nokia. We have owned Nokia shares several times and so far we have realised profits with this share. In total now we are even with Nokia.

First income we received this week was from Telia. On Wednesday we received 57,01 € after taxes and fees deducted. On last day of October we received 19,97 CAD dividends after taxes from Transalta Renewables which is 13,62 €. From LTC Properties we received 7,09 € after taxes and fees deducted.

On the first day of November we had our investment loan payment. We paid back 213 € capital and 6,42 € interests and fees. We also received some dividends. From AT&T we received 96,81 € after taxes and fees deducted. From Verizon communications we received 45,91 € after taxes and fees deducted.

Our investment income in October was 320,94 €. Last year our income was 151,51 in October. We predict that in November we do not get more dividends than last year. Our this year target was 3892,78 €, now we have accumulated 4024,28 € so we have accumulated 103,38%.

After reaching this year target, and setting the next year target to 5300 € we did some archeology work. We dug our archives and tracked down as much information as we could. We were able to dig up most of our passive income back to 2008. There are some inaccuracies in the data, but still most of the income is there.

From year 2008 onwards we have accumulated at least 16 843,45 € passive income, which is suprisingly lot. Income started to grow after 2015, being quite stable from 2008 to 2015.

Saturday, October 26, 2019

4th week of October

Again a quiet week. There were some bad news of our holdings.Nokia announced its q3 results and it was a major disappointment. They also cut off dividends. We are considering selling this constant underperformer if something significant does not show up. This would realise some losses, but we had already given Nokia this year to show us that it can change. Does not seem so. Also Nordea cut its dividend by 42%, but this was expected. We are confident with Nordea. Third annoucement was that Sampo most likely will cut its dividend down to 2.10-2.30 € per share. We do not plan to sell Sampo. These news give us some troubles to keep up increasing our dividend stream.

Now we decided our next year target for passive income. It is 5300 € investment income received to our accounts. This mean that we will increase our goal by 36%, which is quite big increase but we think we can do it.

Now to this week's income. Only Clime Capital paid us dividends. We received 23,38 AUD dividends after taxes, which is approximately 14,34 €. We still need 88,94 € to meet our target for this year. This will happen next week.

Now we decided our next year target for passive income. It is 5300 € investment income received to our accounts. This mean that we will increase our goal by 36%, which is quite big increase but we think we can do it.

Now to this week's income. Only Clime Capital paid us dividends. We received 23,38 AUD dividends after taxes, which is approximately 14,34 €. We still need 88,94 € to meet our target for this year. This will happen next week.

Friday, October 18, 2019

Mid month update

Last week absolutely nothing happened. That's why we did not update the blog. No trades, no dividends. Actually Whitestone REIT paid dividends on 10th of October, but for some reason we did not receive dividends to our account until this week.

We started our week by making a technical buy. As told earlier we have several portfolios and our bank charges fees from inactive portfolios. We bought 1 share of Johnson & Johnson @131 USD. Now our total position at JNJ is 14 shares. We do not need to buy any more shares to this account this year to keep it free for end of first quarter of 2020. Transaction fee is less than one month's charge for passive portfolios.

On Tuesday 15th, we received Whitestone REIT dividends and our normal mid-month dividends, except from Dream Global REIT, which suspended dividend payments after Blackstone wanted to buy Dream Global REIT. From Whitestone REIT we received 50,26 € after taxes and fees deducted. From Realty Income we received 17,15 € after taxes and fees. Last US company who paid dividends on 15th of October was Cardinal Health Inc. We received 36,35 € after taxes and fees. From Inter Pipeline we received 36,46 CAD dividends after taxes deducted. This is approximately 25,02 €. And from Exchange Income we received 16,15 CAD dividends after taxes which is about 11,08 €. We also sold our position at Dream Global REIT @16,64 CAD, which is a little less than what Blackstone offers, but we do not need to wait until end of the year to receive money. This sell brought us 467,00 CAD profit. We reinvested cash and some received dividends to Transcontinental Inc. We bought 200 shares @15,13 CAD.

On Wednesday we received our last dividends for the week. From Main Street Capital we received 20,43 € after taxes and fees. Also we noticed that Main Steet Capital annouced supplemental dividend payable at december. This will increase our dividend income approximately by 24 €.

Our October dividends have now exceeded the last year's October dividends. Now we have accumulated 3789,50 € passive income this year which is 97,35% of our this year's target. We are 103,28 € short from our target. We will exceed our target latest 1st of November.

We started our week by making a technical buy. As told earlier we have several portfolios and our bank charges fees from inactive portfolios. We bought 1 share of Johnson & Johnson @131 USD. Now our total position at JNJ is 14 shares. We do not need to buy any more shares to this account this year to keep it free for end of first quarter of 2020. Transaction fee is less than one month's charge for passive portfolios.

On Tuesday 15th, we received Whitestone REIT dividends and our normal mid-month dividends, except from Dream Global REIT, which suspended dividend payments after Blackstone wanted to buy Dream Global REIT. From Whitestone REIT we received 50,26 € after taxes and fees deducted. From Realty Income we received 17,15 € after taxes and fees. Last US company who paid dividends on 15th of October was Cardinal Health Inc. We received 36,35 € after taxes and fees. From Inter Pipeline we received 36,46 CAD dividends after taxes deducted. This is approximately 25,02 €. And from Exchange Income we received 16,15 CAD dividends after taxes which is about 11,08 €. We also sold our position at Dream Global REIT @16,64 CAD, which is a little less than what Blackstone offers, but we do not need to wait until end of the year to receive money. This sell brought us 467,00 CAD profit. We reinvested cash and some received dividends to Transcontinental Inc. We bought 200 shares @15,13 CAD.

On Wednesday we received our last dividends for the week. From Main Street Capital we received 20,43 € after taxes and fees. Also we noticed that Main Steet Capital annouced supplemental dividend payable at december. This will increase our dividend income approximately by 24 €.

Our October dividends have now exceeded the last year's October dividends. Now we have accumulated 3789,50 € passive income this year which is 97,35% of our this year's target. We are 103,28 € short from our target. We will exceed our target latest 1st of November.

Sunday, October 6, 2019

Q3 summary and first week of October

Third quarter ended on Monday. It is time to make summary of our investments again but first we sum up this week's activities.

On the last day of September we received first time dividends from Transalta Renewables. We received 19,97 CAD after taxes deducted, which is approximately 13,82 €. On the same day we also received 7,23 € dividends from LTC Properties. Also the DRIP and remainder from HSBC arrived on the last day of September. We received 3 shares and 0,53€ cash dividends which adds up to 19,76 € dividends. These raised our September dividend income to 259,32 €, which is 94,6% higher than last year's September dividends.

On the first day of October we received 20,23€ dividends after taxes and fees deducted from Coca Cola. As usual, we made our investment loan payment on the first day of the month. We paid back 213 € principal and 6,76 € interests and fees. We increased our position at Johnson & Johnson by 8 shares @130,30 USD. We also received 2 shares of Saratoga Investment Corp. This increases our dividend income by 42,70 €.

On Wednesday remainder of Saratoga Investment Corp dividends arrived on our account. We received 1,01 € after taxes and fees deducted. Also we received 4,65 € dividends after taxes and fees deducted from Iron Mountain Inc.

Now the quarterly check for our portfolio.

On 30th of September.

Investment funds 10 725,61 €

Shares portfolio 119 731,61 €

Co-op memberships 1 500 €

Gross investments 131 957,22 €

Investment loan 7 657 €

Net investments 124 300,22 €.

Our net investment value has increased 57,54% this year.

Currently we have accumulated 3629,30 € capital income, which is 93,23% of our this year's target. We still need to accumulate 263,48 € to reach the target. We have calculated that most likely we will hit the target first week of November.

On the last day of September we received first time dividends from Transalta Renewables. We received 19,97 CAD after taxes deducted, which is approximately 13,82 €. On the same day we also received 7,23 € dividends from LTC Properties. Also the DRIP and remainder from HSBC arrived on the last day of September. We received 3 shares and 0,53€ cash dividends which adds up to 19,76 € dividends. These raised our September dividend income to 259,32 €, which is 94,6% higher than last year's September dividends.

On the first day of October we received 20,23€ dividends after taxes and fees deducted from Coca Cola. As usual, we made our investment loan payment on the first day of the month. We paid back 213 € principal and 6,76 € interests and fees. We increased our position at Johnson & Johnson by 8 shares @130,30 USD. We also received 2 shares of Saratoga Investment Corp. This increases our dividend income by 42,70 €.

On Wednesday remainder of Saratoga Investment Corp dividends arrived on our account. We received 1,01 € after taxes and fees deducted. Also we received 4,65 € dividends after taxes and fees deducted from Iron Mountain Inc.

Now the quarterly check for our portfolio.

On 30th of September.

Investment funds 10 725,61 €

Shares portfolio 119 731,61 €

Co-op memberships 1 500 €

Gross investments 131 957,22 €

Investment loan 7 657 €

Net investments 124 300,22 €.

Our net investment value has increased 57,54% this year.

Currently we have accumulated 3629,30 € capital income, which is 93,23% of our this year's target. We still need to accumulate 263,48 € to reach the target. We have calculated that most likely we will hit the target first week of November.

Saturday, September 28, 2019

last full week of September

Last week we forgot to report one dividend payment. Lets add it here first. On last week's Friday we received 3,54 € dividends from Dominion energy after taxes and fees deducted.

In this week we received 40,04 € dividends from BlackRock Inc after taxes and fees deducted. HSBC and Saratoga Investment Corp paid their dividend on 26th September but because we are DRIPing those we do not yet see these on our portfolio. Usually DRIPs have taken up to one week before we can see the dividends. Of course we could calculate it but we have been reporting them based on what we can see on our accounts.

This week we bought 230 shares of Monmouth Real Estate Investmen Corp @14,26 USD.

We are now missing 372,88 € of our this years' target, and we have accumulated 90,42% so far. Last quarter is about to start and that has traditionally been worst quarter for us. Still we are very confident that we will reach our target with flying colours.

In this week we received 40,04 € dividends from BlackRock Inc after taxes and fees deducted. HSBC and Saratoga Investment Corp paid their dividend on 26th September but because we are DRIPing those we do not yet see these on our portfolio. Usually DRIPs have taken up to one week before we can see the dividends. Of course we could calculate it but we have been reporting them based on what we can see on our accounts.

This week we bought 230 shares of Monmouth Real Estate Investmen Corp @14,26 USD.

We are now missing 372,88 € of our this years' target, and we have accumulated 90,42% so far. Last quarter is about to start and that has traditionally been worst quarter for us. Still we are very confident that we will reach our target with flying colours.

Saturday, September 21, 2019

Third week of September

Our week started with usual mid-month dividends. On 16th of September we received dividends from two Canadian companies and one US company. From Dream Global Reit we received 9,92 CAD dividends after taxes deducted. This is approximately 6,80 €. From Inter Pipeline Ltd we received 34,46 CAD after taxes, which is approximately 23,62 €. From Duke Energy we received 8,53 € after the taxes and fees deducted.

We also invested most of our Canadian dollars on 16th of September. We decided to buy Methanex Corp shares. We bought 65 shares @51,70 CAD. Now almost all our Canadian dollars are spent.

On 17th September we decided to buy 100 shares of Leggett & Platt Inc @ 41,82 USD.

On 18th we received 20,37 € from Main Street Capital after taxes and fees deducted.

Rest of the week was quiet.

Now we have accumulated 89,30 % of our this year's target, 3476,32 / 3892,78 €.

We also invested most of our Canadian dollars on 16th of September. We decided to buy Methanex Corp shares. We bought 65 shares @51,70 CAD. Now almost all our Canadian dollars are spent.

On 17th September we decided to buy 100 shares of Leggett & Platt Inc @ 41,82 USD.

On 18th we received 20,37 € from Main Street Capital after taxes and fees deducted.

Rest of the week was quiet.

Now we have accumulated 89,30 % of our this year's target, 3476,32 / 3892,78 €.

Saturday, September 14, 2019

Second week of September

On the second week of September we bought a bit more shares and received few dividends. Our week started with dividends on 10th September from Johnson & Johnson which is one of our recent purchases. These were our first dividends from Johnson & Johnson. We received 3,64 € after taxes and fees deducted.

On 11th of September we reinvested money received from dividends and sale of Gladstone. We bought 10 shares of Iron Mountain Inc @33,80 USD. We also increased positions in the energy sector in our portfolio by buying 300 shares of Transalta Renewables Inc @13.30 CAD. We also bought 200 shares of Taaleri @7,38 € and 10 shares of Abbvie Inc @69,17 USD.

Our week ended with dividends from three of our positions. From Whitestone REIT we received 50.06 € after taxes and fees deducted and from Realty Income we received 17,05 € after taxes and fees deducted. From Exchange Income Corp we received 16,15 CAD dividends after taxes. This is approximately 11 €.

Our this week's income was 115,70 € after taxes and fees deducted. This raises our this year's passive income to 3417 €. Now our passive income is 51.8% higher than last year at the same period. We still have some dividends to come this month so the percentage will rise slightly. We have now accumulated 88,65% of our this year's target.

On 11th of September we reinvested money received from dividends and sale of Gladstone. We bought 10 shares of Iron Mountain Inc @33,80 USD. We also increased positions in the energy sector in our portfolio by buying 300 shares of Transalta Renewables Inc @13.30 CAD. We also bought 200 shares of Taaleri @7,38 € and 10 shares of Abbvie Inc @69,17 USD.

Our week ended with dividends from three of our positions. From Whitestone REIT we received 50.06 € after taxes and fees deducted and from Realty Income we received 17,05 € after taxes and fees deducted. From Exchange Income Corp we received 16,15 CAD dividends after taxes. This is approximately 11 €.

Our this week's income was 115,70 € after taxes and fees deducted. This raises our this year's passive income to 3417 €. Now our passive income is 51.8% higher than last year at the same period. We still have some dividends to come this month so the percentage will rise slightly. We have now accumulated 88,65% of our this year's target.

Saturday, September 7, 2019

First week of September

First week of September was pretty busy as we decided to work with our portfolio a bit. Since we reorganized our loans earlier this year we now have little extra money for investments every month.

As in every month, we had our installment of investment loan. We paid back 213 € of capital and 7,95 € interests and fees.

On 3rd of September we received 32,33 CAD dividends from Canadian Utilities which is approximately 22,10 €.

We finalised sale of some of our fixed assets and got some cash for investments. We opened few new positions and entered to new market this week. On 3rd of September we closed our Gladstone Capital Corporation position. We realized 134,99 € profit. The reason for closing the position was that stock price has risen too high. We increased our position in BlackRock by 3 shares @414 USD and 10 shares @415 USD. We also increased our position at Saratoga Investment Corp by 50 shares @25,09 USD.

On 4th of September we bought 2200 shares of Clime Capital @0,94 AUD and 100 shares of National Australia Bank Ltd.

On 5th of September we bought 100 shares of Cardinal Health @44,85 USD and 80 shares of Washington H. Soul Pattinson @20,80 AUD and we received interest income 0,22 CAD which is approximately 0,15 €.

On Friday we received 11,70€ dividends from Southern Co after taxes and fees deducted.

Our this week's passive income was 33,95 €.We only need to receive 557,53 € to reach this year's target. It seems that we will beat our estimate by 16%.

As in every month, we had our installment of investment loan. We paid back 213 € of capital and 7,95 € interests and fees.

On 3rd of September we received 32,33 CAD dividends from Canadian Utilities which is approximately 22,10 €.

We finalised sale of some of our fixed assets and got some cash for investments. We opened few new positions and entered to new market this week. On 3rd of September we closed our Gladstone Capital Corporation position. We realized 134,99 € profit. The reason for closing the position was that stock price has risen too high. We increased our position in BlackRock by 3 shares @414 USD and 10 shares @415 USD. We also increased our position at Saratoga Investment Corp by 50 shares @25,09 USD.

On 4th of September we bought 2200 shares of Clime Capital @0,94 AUD and 100 shares of National Australia Bank Ltd.

On 5th of September we bought 100 shares of Cardinal Health @44,85 USD and 80 shares of Washington H. Soul Pattinson @20,80 AUD and we received interest income 0,22 CAD which is approximately 0,15 €.

On Friday we received 11,70€ dividends from Southern Co after taxes and fees deducted.

Our this week's passive income was 33,95 €.We only need to receive 557,53 € to reach this year's target. It seems that we will beat our estimate by 16%.

Saturday, August 31, 2019

Last week of August

Last week of August was very quiet as we expected. We received our usual end month dividends, nothing else. From LTC Properties we received 7,17€ after taxes and fees and from Gladstone Capital Corp we received 4,74€ after taxes and fees deducted.

We find it very hard to find good stocks to buy with decent valuation. In our portfolio every stock which we would like to increase our holdings is at least 20% more expensive than our average price. We opened new position on Friday. 3 shares of Blackrock Inc @422,05 USD. We are still looking forward to make at least one buy next week. We are not sure yet if we are going to increase some of our holdings or buy something new.

In August we received 51% more passive income than last year's August. After the 8th month of the year we have accumulated 84,81% of our this year's target by collecting total of 3301,30 € worth of dividends.

We find it very hard to find good stocks to buy with decent valuation. In our portfolio every stock which we would like to increase our holdings is at least 20% more expensive than our average price. We opened new position on Friday. 3 shares of Blackrock Inc @422,05 USD. We are still looking forward to make at least one buy next week. We are not sure yet if we are going to increase some of our holdings or buy something new.

In August we received 51% more passive income than last year's August. After the 8th month of the year we have accumulated 84,81% of our this year's target by collecting total of 3301,30 € worth of dividends.

Sunday, August 25, 2019

3rd Week of August

Not much happened this week. We received dividends only from Main Street Capital. On Wednesday we received 20,32 € after taxes and fees.

Next week will be quiet too and then the last month of quarter starts after that. We have to make transaction on one of our portfolios to avoid bank fees for the next quarter. We planned to make a bit larger investment this time than just reinvest the dividends accrued in that portfolio. To finance the purchase we reduced our housing loan payment for next month by 1000 €. We still have a little more than 27 000 € allowance left to reduce our housing loan payments. If we pay back more, the allowance increases until agreed limit is reached. We planned to invest around 1200€ in first week of September.

Now we have accumulated 84,50% of our this year's target and we have increased our passive income by 55,32% YOY.

Next week will be quiet too and then the last month of quarter starts after that. We have to make transaction on one of our portfolios to avoid bank fees for the next quarter. We planned to make a bit larger investment this time than just reinvest the dividends accrued in that portfolio. To finance the purchase we reduced our housing loan payment for next month by 1000 €. We still have a little more than 27 000 € allowance left to reduce our housing loan payments. If we pay back more, the allowance increases until agreed limit is reached. We planned to invest around 1200€ in first week of September.

Now we have accumulated 84,50% of our this year's target and we have increased our passive income by 55,32% YOY.

Subscribe to:

Comments (Atom)

-

This was pretty good week, as usual in middle of the month. We finally received Pepsico dividends 13,97 € on Tuesday. On Wednesday we recei...

-

Only one working day left in July. We are going to receive some dividends next Monday so we cannot close the month yet in this blog. Last t...

-

First two weeks of August have passed and not so much has happened. During this period July ended and final amount of dividends in July was ...